Welcome to The Micah Project! Our mission is to advance the gospel of Jesus Christ as a means to reconciliation, justice, and mercy.

“And what does the LORD require of you? To act justly and to love mercy and to walk humbly with your God” (Micah 6:8, NIV). The Micah Project has three areas of emphasis: Technical Empowerment- We help build the capacity of organizations whose missions demonstrate a Biblical worldview. We apply knowledge and experience gained over more than 60 years of combined service to the nonprofit sector. Our focus is in addressing developmental needs involving financial management, board governance, legal compliance, and special event planning. Learn more . . . Evangelistic & social justice empowerment - We support activities that proclaim the life transforming power of the Christian gospel, including the sponsorship of speakers, evangelistic events, and the creation of published materials that support this objective. Financial empowerment - We make grants, contributions, and below-market loans to help seed activities that proclaim the gospel. Grants and loans are accompanied by consultative support where appropriate.

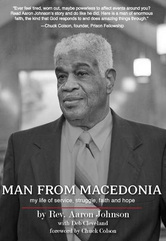

Man from Macedonia: My Life of Service,

|

NewsThe Micah Project partners with Child Evangelism Fellowship to Reach Children with The Good News of the GospelDennis and Debbie serve as volunteers with Child Evangelism Fellowship. Debbie serves on the International Board of Trustees, where she serves as secretary and chair of the USA Ministries Committee. Dennis acts as a consultant with the finance committee.

Child Evangelism Fellowship is the largest ministry in the world dedicated solely to children. We have active work in over 200 countries. The signature program of CEF is the Good News Club, held anyplace where children safely gather. The most common location for Good News Clubs in the US is in the public school, after school hours. www.cefonline.com The International Board of Trustees at their meeting in Warrenton, MO, September 2022.

The Employee Retention Credit –

What Nonprofits Need to Know Originally enacted as part of the CARES Act in March 2020, and subsequently voted into law last December, the Employee Retention Credit (ERC) may now be claimed by eligible employers—and that includes tax-exempt nonprofit organizations—that previously received a Paycheck Protection Program (PPP) loan. Since most eligible employers opted for a PPP loan instead of claiming the ERC, this relief credit was generally off the radar of many eligible employers. December’s vote has changed that, and Dennis brings us up to date with the most recent ERC developments through April of 2021. Click to read the article published in Blue Avocado. Pending Regs Call for Closer Look at Donor-Advised Gifts

Under pending Treasury Regulations, donor-advisors, donor-advised funds, and recipient charities need to understand how gifts from a DAF can affect public charity status and plan for implementation of the new rules. See the article … Donors Beware: Fundraising Incentives Can be Hazardous to Your Financial Health

It’s helpful to review recent IRS guidance and refresh a few tax provisions affecting gifts providing donor benefits and made through donor advised funds, individual retirement accounts, and private foundations that can have a most unwelcome and potentially chilling effect on donor relations. Donor incentives can produce marvelous giving results, but their fraught with peril for the unwary. Read more … IRA Charitable Rollover: A Gold Mine with a Trap

IRA charitable rollovers are now a permanent part of the tax law. There is at least one little known caveat that you must be aware of in order to protect your clients and donors from adverse consequences. See the article. |

The Micah Project is the registered operating name of The Deborah and Dennis Walsh Foundation, a North Carolina nonprofit corporation recognized as a tax exempt private operating foundation under Section 501(c)(3) and 4942(j)(3) of the Internal Revenue Code. The Micah Project is qualified to receive tax deductible contributions under the rules applicable for contributions to public charities pursuant to Section 170(b)(1)(A)(vii).

Copyright © 2007-2023 The Deborah and Dennis Walsh Foundation

Copyright © 2007-2023 The Deborah and Dennis Walsh Foundation